Glocalization

Mariam Tchanturia

Glocalization is a tactic companies use while entering the diverse market. As glocalization stands for understanding the customs and needs of local people and designing products relatedly, it is key to success for the companies outsourcing worldwide. Introducing brand new products is sometimes attracting the customers in foreign countries, however products which are customized to their culture and wants has more demand. There are many famous companies, which are modifying their products to increase the sales in the countries they are outsourcing in. For example, MacDonald’s Is turning its beef burger into Tikki burger in India and Starbucks is introducing new types of teas in its branches located in Asia. As the product is new, however designed according to the local people’s daily lives, the companies are generating sales using glocalization.

There are several ways for the TBC bank to go glocal. Nowadays the bank is only targeting the Georgian audience and is designing all of its products/services accordingly. Firstly, it can design its credit/debit cards with the traditional ornaments, symbols and colors of the targeted country. The complimentary design will make people feel like it was customized for them and will be more willing to purchase them. Secondly, the bank should study the interest rate the local banks have and offer better deals then them. The easier it is for people to get a loan and the lower the interest in return, more of them are going to join the bank. Last but not least, the bank should represent its safety and superiority according to the local peoples believes. As there are different ways to prove such factors, the TBC bank should consider the traditions and customs of local people.

Nowadays, TBC bank is using differentiated (segmented) marketing strategy. With this strategy, the audience is divided into segments and there are different offers for each of them. For example, for people aged between 18-25 TBC bank offers the student cards. With these cards, maintenance fee each month equals to zero and they have many discounts in different shops. With such cards, students are enabled to use public transport for lower price, get discounts on food delivery or even at clothing shops in the mall. Other then the age differentiation, the bank differentiates the workforce as well. For example, for people who have become self-employed after covid19, it provides the special loan with great benefits. To sum up, the bank is differentiating audience in a couple of ways and gives them different offers.

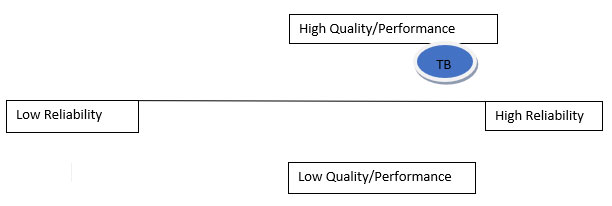

Positioning map is a great way to determine and asses the performance of the company In the market. In order to make a positioning map, the company should use the attributes which are demanded by the customers, such as: price, quality, features, reliability and performance. In TBC bank’s example, there are major factors, shown below.

Overall positioning strategy consists of couple of aspects, such as: More for more, More for the same, more for less, the same for less and less for much less. Even though, the bank’s products are quite budget friendly, it offers luxury cards as well. The Luxury gold cards are comparatively expensive and attract such audience which values its big price. Compared to other banks in Georgia, TBC bank offers card for lower price which means, they sell offer for the lower price as well. Taking into consideration that some cards are even free to get, it is involved in more for less factor as well.

Due to the fact that TBC bank had a massive challenge to face in 2019, I believe that value-driven marketing is the key tool that gave it a hand to overcome it. I personally like describing this approach as putting yourself in the customers’ shoes, analyzing their needs and developing the product/service to meet them. Since the year of 2020, Covid-19 pandemic has turned people’s lives upside down and has resulted in a financial crisis. Many people have lost their jobs and have become self-employed in order to survive. The TBC bank has analyzed what was happening in the country well and has come up with a program called “Credit for you”. With the credit, self-employed people are able to endure the crisis and get financially stable. The bank has also published many short videos of teachers, farmers and entrepreneurs using this type of credit and talking about its advantages. With this program, the bank has attracted a lot of people and has gained back its popularity and reputation. It should also be mentioned, how hard the bank has worked on publishing the card with new designs, which citizens are able to use in the public transport and not waste time on transferring funds from one account to another. The new cards’ design is minimalistic but quite unique as well and the convenience its qualities bring are making more people interested.

There are specific demographic, Geographic, psychological and behavioral segments TBC bank concentrates on. According to its way of marketing and the targeted audience the demographic segmentations it focuses on are Georgian Millennials and the Gen Z. The TBC bank is doing its best to break the stereotypes about the banks in general and is presenting it in a way that attracts the youth. Shifting from typical offices it has made the branches more colorful and outstanding and has made the environment more customer friendly. As many people are concentrated on keeping themselves financially stable and are looking for new opportunities, the bank has taken this chance and has concentrated on such psychological factor. Giving out loans for the self-employed people, TBC bank has been meeting the client’s needs and boosting the revenue to the organization. 2 main aspects of behavioral segment are purchasing and spending habits, which are crucial to understand. While some tend to go for the budget-friendly credit/debit cards, some people are lovers of luxury goods/services. This is why TBC bank gives various options of goods/services with a considerably big price range.